The Latest from TechCrunch |  |

- 160-Year-Old American Express Out-Innovates Google and Groupon

- Vroom! The BlueDrone Is An R/C Car You Steer With Your Android Phone

- Joy Factory’s Zip Touch-n-go Charging Station Has Cute Dimples And Three Tails

- Google+ iPhone App Now Live In The App Store (Screenshots)

- SV Angel, True Ventures And Others Put $1 Million Into Interest-Based Connections App One

- Audiosocket’s Music As A Service Allows Startups To Offer Licensed Music To Users

- Apple’s Lion Creates Dilemma For Older Quicken Fans

- Eric Schmidt On The HTC-Apple Brawl: “I’m Not Too Worried About This”

- Intel Buys Semiconductor Company Fulcrum Microsystems

- New Robot Touch Sensor Paves The Way To More Lifelike Humanoids (Video)

| 160-Year-Old American Express Out-Innovates Google and Groupon Posted: 19 Jul 2011 09:18 AM PDT This morning American Express is launching a new deals platform in partnership with Facebook that should make big waves in the payments and offers space. Winners: Facebook, American Express, small businesses With the new platform, merchants will be able to target deals at American Express cardholders on the Facebook platform. Initial launch partners include H&M, Sports Authority, Dunkin’ Donuts, Sheraton, Westin, Travelocity and Celebrity Cruises. Although the launch focus is on big national brands, the platform is self-serve and well suited to the needs of small business. This presents a big and credible threat to Groupon, LivingSocial, Google Offers and other daily deal providers. The platform covers both one-time and loyalty offers. Some examples of the offers that could be presented:

The offers work much like the recent foursquare and American Express deal: you link an American Express card to your Facebook account, select an offer to load it on your card and then pay using your AMEX. If you meet the offer criteria, you get the discount as a statement credit. This offers a significant benefit to retailers: no staff training required. Training has long been the bane of promotions and is often executed poorly. I recently spent 30 minutes at Radio Shack trying to redeem a foursquare offer. That’s a terrible experience for the consumer and the merchant. For merchants, it also provides additional benefits over Groupon, Google Offers and LivingSocial. Ironically, the daily deals model is currently about as targeted as media that were available when AMEX was founded more than 160 years ago. For the most part, it’s at the region level (although it is moving towards a more geographically targeted approach). AMEX can do much better. This allows merchants to reach just the customers who are within their trade area, instead of offering deep discounts to deal seekers who come from 45 miles away and would never return at full price. Merchants also benefit from analytics that AMEX can provide. Because it processes all of the transactions through its network, it can report on that data. AMEX captures important metrics like total spend. Tracking beyond redemptions is another significant area where Groupon, Google Offers, and LivingSocial fall down. In the future, I would look for AMEX to integrate this platform with transaction history data and its popular Membership Rewards program. With transaction history, merchants could better target cardmembers. Instead of sending out an offer to anyone in the city who wants a cheap massage, the offer could be sent to people within 5 miles who have shown a history of buying spa services and spend a lot of money each year. Membership Rewards integration could allow consumers to redeem points at any merchant on the American Express network, similar to the way in which consumers can redeem points for Amazon purchases. The AMEX platform illustrates a big difference in business model. Groupon and other daily deal providers need to make their money on a one time deal with the merchant. As a result, in my opinion they’re doing a lot of deals that are bad for businesses. AMEX is forgoing that upfront revenue to build a long term relationship with the merchant that pays off over time. AMEX wins in three ways: driving traffic onto its network for existing merchants, providing a clear differentiator to encourage new merchant accounts and encouraging new cardholders. The biggest question in my mind is how much marketing effort AMEX and Facebook will put behind this. The platform itself has the potential to become a serious Groupon competitor. But it needs marketing muscle behind it. If they don’t, it’s just another product announcement by a big company. The AMEX/Facebook announcement also reinforces the folly that is Google’s bet on NFC. For some reason, Google is enamored with that technology. NFC is a solution in need of a problem. In the best case scenario, that investment will pay off in 3 to 5 years for Google. AMEX and Facebook are launching a product that works today. The other big loser in this is foursquare. The announcement is pretty much the same thing that foursquare did with American Express. Except that in this case, it has the potential to reach more than 750 million unique users. |

| Vroom! The BlueDrone Is An R/C Car You Steer With Your Android Phone Posted: 19 Jul 2011 09:15 AM PDT Ever since I was a tyke, I’ve had a special lil’ nook in my heart reserved for R/C cars. I’d rocket them off stairs. I’d build terrifyingly shoddy ramps out of LEGO blocks and cardboard. I’d repeatedly crash them into my older sister’s ankles and feign innocence by blaming my childish lack of hand-eye coordination (Remind me to apologize to my sister for being a little bastard.) My only problem: I’d always, always lose the driving controller. Seriously — I somehow always ended up with half of the equation; one brick of an R/C car sitting silently, with no means of being told where and when to go*. That, or the damn controller was out of batteries. The BlueDrone is a Kickstarter project aiming to do away with those endlessly wandering/wavering remotes by replacing them with… your Android phone. The concept probably doesn’t need too much explaining: your pair your Android phone with the car via Bluetooth (hence “Blue”Drone), then steer the car with the onscreen controls built into a custom application. Check out their demo video: The BlueDrone can eek roughly 3 hours of drive time out of 3 AA batteries, and has a range of about 30 feet. It gets a bit cooler: tapping into the capabilities of the phone to bring new tricks into the mix, the custom app will allow the driver to use the device’s accelerometer to steer as an alternative to the onscreen wheel. You’ll probably have to provide your own engine revving/tire screeching sounds, though. As with all Kickstarter projects, whether or not this thing actually gets built all boils down to whether or not they can raise the funds. They’re aiming to raise a rather sticker-shock-tastic $200,000, of which they’ve raised a bit over a $1,200 in their first day. Dropping $59 into the project gets you a R/C car of your own, with other pledge values offering up stuff like shirts, wrist bands, or (if you’re willing to plunk down a ton of cash) multiple cars and an Android phone to control everything. Here’s their project page. The first person who mods this thing to fire little red shells at other Bluetooth-controlled R/C cars wins my undying love and affection. * In hindsight, I’m realizing that my sister probably had all the controllers locked in a drawer somewhere. Guess I can’t really blame her. |

| Joy Factory’s Zip Touch-n-go Charging Station Has Cute Dimples And Three Tails Posted: 19 Jul 2011 09:08 AM PDT Here's a weird, albeit kinda cool, little conductive charging pad. Created by the Joy Factory, the Zip Touch-n-go Multi-Charging station basically has three little "Zip tails" that connect to the charging port on your phone, camera, etc., while the other end magnetically attaches to the dimples on the charging pad. The Zip Touch-n-go comes with two micro-USB zip tails and one mini-USB zip tail, and according to the company, they help reduce energy loss. The charging station also includes a 2100mA power adapter, allowing for up to three phones to charge at once. We're not quite sure where this charger is supposed to fit in the market. Most conductive charging pads are slower than you're average wired charge, but provide a wireless and more decorative way to charge up your electronics. Adding mini-wires to the equation may not be the best way to steal a chunk of that market, unless the Zip Touch-n-go is predominantly faster than other conductive chargers (which it very well may be since the Zip tails connect directly to the device). In the house, short wires like these won't really make a difference as you could probably just pick the phone up off the charging station and talk with the Zip tail still connected to the handset. Unfortunately when you're coming or going, you'll still have to plug in and unplug to get your charge on. Either way, this is sure way to stump your friends and could look pretty cool sitting on a night stand. Pre-orders for the Zip Touch-n-go Multi-Charging station have already begun, with an MSRP of $79.95. Extra Zip tail receivers are available to buy as well, although the Joy Factory did not provide individual Zip tail prices. The Zip Touch-n-go will be available through online and in-store resellers at the end of July. |

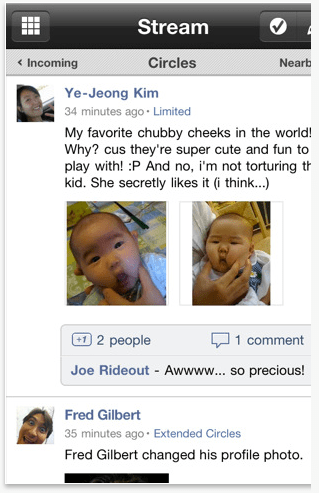

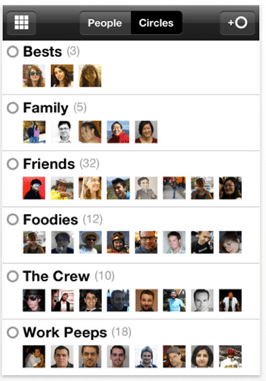

| Google+ iPhone App Now Live In The App Store (Screenshots) Posted: 19 Jul 2011 09:00 AM PDT Google+’s iPhone app is now live in the App Store, and you can download the free app here. From Google’s description of the app, Google+ for mobile makes sharing the right things with the right people a lot simpler. Huddle lets you send super-fast messages to the people you care about most. And no matter where you are, the stream lets you stay in the loop about what your friends are sharing and where they're checking in. Similar to the web product, Google+ for iPhone includes Circles, your stream of updated from contacts, and Huddle, for group messaging in your circles. While the Google+ Android app was ready to go on day one, the Google+ iPhone app had remained in review with Apple. Until now, iPhone users have had to access a mobile web version of Google+ in Safari, which wasn’t nearly as feature-filled as the Android app. It appears that the iPhone app and Android app are fairly similar in functionality except for the instant upload feature that is included in the Android app. Instant Upload automatically uploads videos and photos to your Google+ album in the cloud. As Larry Page told us last week, Google+ now has has over 10 million users who have created profiles (after two weeks), and these users are sharing and receiving 1 billion items per day.

|

| SV Angel, True Ventures And Others Put $1 Million Into Interest-Based Connections App One Posted: 19 Jul 2011 08:59 AM PDT 19-year-old entrepreneur Cory Levy is trying to solve a problem. He believes that we miss millions of opportunities to meet like-minded people because we don’t have any knowledge of the people around us. There could be people within feet of you at a coffee shop, office building or bar who share friends, interests and professional connections, but we may never realize this in the physical world. To fix this, Levy wants to give people knowledge of who and what is around us. Today, Levy and his co-founder Michael Callahan are debuting One, a mobile app that notifies you when there are people around you that share your interests. One already has an all-star group of backers, who have put over $1 million in seed funding in the startup. Investors include SV Angel, Keith Rabois, Gary Vaynerchuk, Naval Ravikant, Michael Dearing, The best way to visualize One, which will launch an iOS app in the Fall, is that the app is a way to ask the people right next to you thousands of questions and get notified if they answer yes enough times. When you sign into the app, your interests and information is pulled from Facebook (and you can manually , and the app will track your location to determine who matches your interests nearby who have also downloaded One. Levy explains to me that the startup is launching on college campuses as a way for students to meet each other in a close proximity. Currently, it looks like One may make its initial debut at UC Berkeley this Fall. The idea behind One could be compelling in certain setting like college campuses or even conferences. Levy says he plans to expand the app to Android as well as will create a web presence as well. Aside from One, Levy’s background is impressive for a 19-year-old. Prior to One, he started several companies including an educational startup, a t-shirt printing company, and a sports memorabilia company. He was only 14 when he founded his first startup. |

| Audiosocket’s Music As A Service Allows Startups To Offer Licensed Music To Users Posted: 19 Jul 2011 08:59 AM PDT Audiosocket, an indie music licensing and technology company, is launching a new platform today called Music as a Service (MaaS), which gives developers a way to offer users the ability to license music for applications. So content producers will be able to search, discover and license music from Audiosocket's catalog of over 33,000 songs from more than 1,900 artists and composers around the world. MaaS can be integrated into third party photo and video sharing services, ad agencies and more. Partners pay nothing up-front to integrate MaaS, and content creators take on the licensing charges. The virtue of using the platform is that content creators don’t have to worry about the hassle of licensing the music they want to use, because Audiosocket takes care of this. MaaS provides worldwide music licensing with automated licensing generation and payment processing, simplifying what has been a notoriously challenging process for content creators, and creating new revenue streams for artists and partners. For example, slideshow creation tool Animoto is an Audiosocket client, and Audiosocket says this integration helped shape the vision for the MaaS platform. Audiosocket faces competition from Pump Audio and Jingle Punks. |

| Apple’s Lion Creates Dilemma For Older Quicken Fans Posted: 19 Jul 2011 08:43 AM PDT Intuit’s “Quicken 2007 for the Mac” users have a problem. The personal financial accounting software is not going to work under Lion, Apple’s new OS 10.7, due to be released as early as Wednesday. Intuit suggests three solutions. But each has its own flaws, especially if you want to track investments, reconcile your financial statements or not have to buy 3 software programs or a PC. There are non-Intuit alternatives out there, each with their own fan base. None of them match Quicken 2007, a far-from-perfect but still very useful, powerful program. Software is supposed to get better over time, but for Mac home accounting users, that’s not the case. One of the very first killer ‘apps’ for Apple computers was VisiCalc, a spreadsheet program used by some to balance checkbooks, track credit cards and determine net worth. We’ve come a long way since then, but for Mac users looking for a traditional and full featured personal accounting program, there is no easy solution. Quicken 2005, 2006, and 2007 won’t work in Lion because Apple has dropped support for Rosetta. You can’t blame them. Rosetta was software designed so PowerPC-based programs can run on Intel-based Macs, starting with Mac OS X. It’s hard to believe but OS X was introduced 10 years ago. Rosetta was just supposed to bridge the gap until developers had time to re-write their software for Intel-based Macs. But, Quicken 2005, 2006, and 2007 weren’t updated and still require Rosetta. After a gap of 3 years, Intuit came out with an Intel-based program, “Quicken Essentials for Mac.” It’s one of the options Intuit is pushing for users of the older software. There’s even a limited time 50% discount. While this might work for some, “Essentials” is really “Just The Very Basics”. Even Intuit admits on its website, “this option is ideal if you do not track investment transactions and history, use online bill pay or rely on specific reports that might not be present in Quicken Essentials.” Next. The Tuaw’s site had the best imagery, showing Quicken Essential being flushed down the toilet. Intuit also suggests users could switch to Quicken Windows. The Windows product has always been a more robust and stable version. But few Mac users are not going to buy a PC just for Quicken. While running a PC virtualization program like Parallels or VMware Fusion on the Mac is possible, it can be a frustrating experience. And you need to buy and troubleshoot three programs: Windows, the virtualization program and Quicken. No thanks. Re-booting your Mac in Windows each time you want to use Quicken is a non-starter as well. Intuit’s third suggestion is former TechCrunch 50 winner Mint. Intuit purchased Mint in 2009 for $170 million. Before the acquisition, it was growing like gangbusters. Last December, TechCrunch reported on concerns Mint was losing some top executives and users weren’t happy. The company responded saying there was “no glut of departures” and it was working on iPad and mobile apps. There’s still no native iPad app. From a user perspective, Mint does offer a free and new way to manage your money. According to Mint’s website, over 5 million people use it. But for some users who liked the features of Quicken, it’s not the answer. You can’t import your old Quicken data to Mint. In fact, you can’t enter any transactions in Mint. That’s a feature not a bug. Instead, you enter your account info and Mint pulls in your transactions automatically. This feature can be a big plus, but there is no ability to reconcile your credit card and bank statements – a pretty basic requirement for many. Because the transaction data is read-only, you can’t make your own adjustments or include a cash account. It’s also works in the cloud. While another great feature for some, others want to keep their financial data offline, despite assurances of privacy and security. (Ok, all your data is online already, but its not bundled together begin one login.) There are several non-Intuit programs trying to take advantage of the situation. One of the most popular options, iBank, proudly advertises it’s “Ready for Lion” and fully compatible with Mac OS 10.7. I found the UI a bit awkward. While it did import my Quicken data files, the investment section is weak and the report customization is poor. Another frequently mentioned and popular alternative is Moneydance, also “fully compatible” with Lion. It has some good features and does a lot right. But I found the interface very quirky. For example, you can’t add categories on the fly. Reports could not be customized. The budgeting setup was confusing and lacking. Moneydance is written in Java, so it will run on Windows, Mac and Linux. But a Java app might be a turnoff for some. There are a batch of other basic programs available but they don’t match Quicken 2007′s features either. This list includes Checkbook Pro, iCash, Liquid Ledger, and SEE Finance. Other options include Quickbooks by Intuit or AccountEdge. But they are designed for business and are missing many personal finance software features like tracking stock market investments. Of course, Quicken 2007 users don’t have to upgrade to Lion. There is no requirement to upgrade right away. But then you won’t get to take advantage of Lion’s cool features. And sooner or later, you will need to upgrade. Hopefully by then, new developers will emerge or the current offerings will get better. |

| Eric Schmidt On The HTC-Apple Brawl: “I’m Not Too Worried About This” Posted: 19 Jul 2011 08:33 AM PDT It's looking like big brother Google is stepping in to help out HTC in its current patent battle with Apple. At a Google mobile conference in Tokyo, executive chariman Eric Schmidt seemed confident that HTC would somehow pull out a win against Apple, despite the fact that a judge approved Apple's ITC import ban request. "We have seen an explosion of Android devices entering the market and, because of our successes, competitors are responding with lawsuits as they cannot respond through innovations," said Schmidt. "I'm not too worried about this." Judge Carl Charneski's decision that HTC is in violation of Apple patents has some widespread consequences for Android phones in general. By extension, any Android phones with the same technology described in those two patents are vulnerable to an attack from Apple. Schmidt wasn't altogether clear about how exactly Google plans to aid HTC, reports ZDNet Asia. Schmidt was asked how Google would respond should the Taiwanese phone maker lose this battle, namely whether or not Google would provide financial support to a defeated HTC. Schmidt responded by saying, "we will make sure they don't lose, then." [via CNET] |

| Intel Buys Semiconductor Company Fulcrum Microsystems Posted: 19 Jul 2011 08:22 AM PDT Intel has announced the acquisition of fabless semiconductor company Fulcrum Microsystems. Financial terms of the deal, which is expected to close in the third quarter of 2011, are not being disclosed. Fulcrum Microsystems designs Ethernet switch silicon for data center network providers. Fulcrum’s provide interconnect devices for storage, computing and networking backplane, and interconnect applications in the United States and internationally. The company's products include FocalPoint, which includes Ethernet switch/router chips; ControlPoint Software Suite that comprises Ethernet bridging, switching, and routing software modules; and PivotPoint SPI-4.2 Interconnect Chip. Intel says that as demand for data continues to increase, there is a growing need for high-performance, low-latency network switches to support cloud architectures and the growth of converged networks in the enterprise. Fulcrum Microsystems’ 10GbE and 40 Gigabit Ethernet switch silicon help support this. Kirk Skaugen, Intel vice president and general manager, Data Center Group, says that Fulcrum’s chips will help Intel become a “comprehensive data center provider that offers computing, storage and networking building blocks." Fulcrum’s technology, Skaugen explains, complements Intel's processors and Ethernet controllers. Fulcrum has raised $81 million from Granite Ventures, Infinity Capital, New Enterprise Associates, Palomar Ventures, Worldview Technology Partners, TI Ventures, and The Athenaeum Fund. Intel also recently acquired the assets of SySDSoft to accelerate its 4G LTE efforts. |

| New Robot Touch Sensor Paves The Way To More Lifelike Humanoids (Video) Posted: 19 Jul 2011 08:06 AM PDT Robots these days, especially humanoids, have one problem: it doesn’t feel nice or lifelike when you touch them. This is where an invention by Japanese robot startup Touchence comes in. Their so-called ShokacCube, made of polyurethane, is the world’s first soft touch sensor specifically designed for robots. The sensor detects touches in three dimensions and is pressure-sensitive: if used in a humanoid’s cheek, for example, the robot in question can distinguish if that body part is being just lightly touched or pinched. And as the ShokacCube is covered in soft foam and soft and flexible itself, it does away with the usual metallic feeling humans get when touching a robot. The ShokacCube would particularly make sense when used in therapeutic robots, for example. Touchence plans to roll out the first samples for ShokacCube type B (type A was released in December last year) next month. The company expects to have a more advanced type C model ready by April 2012. This video, shot by Diginfonews in Tokyo, provides more insight: |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment