The Latest from TechCrunch |  |

- As Windows 8 Nears Public Debut, Microsoft Ditches “Metro” Brand (P.S. It Doesn’t Matter)

- Samsung’s Next Galaxy Note To Make Its Grand Debut In Berlin On August 29

- One Jackson Crowdsources Kids’ Apparel With Contests That Lead To Clothes You Can Buy

- Competition Weighs Down HTC In Q2: Sales Drop 27% To $3B; Operating Profit, EPS Down By 57%; Lowers Q3 Outlook

- Dear Facebook, It Could Really Be This Simple

- The Platform Ecosystem Wars: Rome Is Burning

- Task Manager Todoist Receives a Major HTML5 Update

- LevelUp Now Has $21M To Take On The Squares Of The Mobile Payment World

- How Facebook Could Save Its Shattered Share Price

- Oops! American Express Never Agreed To Be Part Of Google’s Big Wallet Upgrade (Update: Google Responds)

- WordPress Launches Retina Support For Gravatar And All Hosted And Self-Hosted WP Sites

- FreeCreditReport’s Ed Ojdana And Facebook’s Chris Kelly Back Movie Distribution Startup GoDigital

- YC-Backed VoiceGem Brings Communication Back To The Future With Asynchronous Voice Messages

- LocalBonus Raises $900,000 To Provide A Universal Loyalty Program For Anyone With A Credit Card

- Hacker Posts Hilarious, Offensive Messages From Seven MLB Teams’ Facebook Pages

- Apple’s iPhone 5,2 Prototype Showing Up In Server Logs

- LinkedIn’s Jeff Weiner On Password Theft: With 174M Members, ‘Health Of Our Network’ Is Strong As Ever

- Activision Q2 Surprises The Street Again On $1.08B Revenue And $0.16 EPS, Raises Outlook

- With Competition Looming, Zipcar’s Q2 2012 Revenue And Earnings Disappoint

- The Protean Echo Reduces All Of Your Credit Cards To One Ubercard

| As Windows 8 Nears Public Debut, Microsoft Ditches “Metro” Brand (P.S. It Doesn’t Matter) Posted: 03 Aug 2012 07:27 AM PDT  Microsoft is abandoning its “Metro” branding – the branding that refers to the clean, modern, tiled layout that defines many of its consumer-facing products including Windows 8, Windows Phone, Xbox 360, Office 2013 and more. For over a year, Microsoft has talked about “Metro” in press conferences, blog posts, tutorials, and guides. The reason for the change has to do with a dispute between Microsoft and a European partner, German retailer Metro AG, who has threatened legal action for infringing on its “Metro” trademark. Oops. Microsoft, of course, is positioning this news as no big deal, saying that “Metro” was always intended to be an internally used code name, not something related to the company’s commercial branding efforts. (Right. Which is why Microsoft is transitioning to new branding without, you know, actually having a new name picked out yet.) But Microsoft may be right on one thing: it’s not really a big deal. Remember what happened with the iPad? Look, Microsoft doesn’t exactly have a good track record with naming its products and related features, whose labels seemed picked out by a committee of lawyers, not actual people. It even had seven different names for seven different versions of Windows 7. Talk about product confusion. And certainly, many of the names Microsoft picks for these kinds of things seem like they were thought up by people who know nothing about branding. (Does anyone know the difference between Windows 7 Home Premium and Ultimate and Pro? What about Basic and Starter?) That Microsoft actually came up with something as catchy as “Metro” almost seemed like an accident. And, as it turns out, it seems it was. But consumer branding, while important, is not all that matters here as Microsoft prepares to launch Windows 8 and its Surface computer. Let’s take a trip down memory lane, shall we? When Apple revealed the name for its new tablet computer was going to be called the iPad, there was some notable backlash. You see, the “iPad” seemed to recall an association with some…um….feminine hygiene products. I am not making this up. It may seem laughable today, but back in January 2010, even The New York Times was reporting on the surrounding brouhaha on its Bits blog:

No one was cutting Apple any slack. MSNBC called it a joke. And MAD TV went on to do a hilarious skit which actually involved the iPad as a feminine hygiene product. Granted, the iPad’s branding only initially alienated around half its potential market. Men, not surprisingly, didn’t tend to make an immediate connection. But thanks to the blogged and reblogged faux outrage, they soon got in on the joke, too. Really, negative reaction to branding couldn’t get much worse than this, right? But what did the iPad go on to do? Only become the best-selling tablet computer of all time. That’s right. Apple could have called this thing anything it wanted, and it would probably still be seeing record-breaking sales. So Microsoft will soon put Metro-gate behind them, and maybe with something as uninspired as “Windows 8-style UI.” It doesn’t matter. What matters in the end is that the company focuses on building a great product people actually want to buy. Build something amazing. Ship it. It’s that simple. It’s just not that easy to do. |

| Samsung’s Next Galaxy Note To Make Its Grand Debut In Berlin On August 29 Posted: 03 Aug 2012 06:25 AM PDT  These past few weeks have been quite the ride for Samsung’s Galaxy Note devotees — a variant of the original model is finally (and officially) on its way to T-Mobile’s airwaves, and a report out of South Korea pointed to some nifty upgrades in place for the phablet’s successor. Now there’s a new, even juicier tidbit for those phablet fans to mull over. A Samsung spokesperson confirmed to Reuters last night that the company would indeed show off “the next Galaxy Note” at an event in Berlin on August 29 — just two days before the city’s massive IFA trade show is slated to kick off. Sadly, said spokesperson wasn’t feeling very gabby when it came to specifics about the device — even just the name would’ve been nice — but early reports hinted at the inclusion of a quad-core processor and an even larger 5.5-inch display. Should those details hold true, it seems like a natural (if conservative) step for a device that pushed plenty of limits the first time around. More than a few people (myself included) weren’t initially sold on the concept of pairing an awfully wide phone with something as seemingly passe as a stylus, but the original went on to sell 7 million units as of this past June. Not too shabby, Samsung. This turn of events also casts some doubt on the big August 15 unveiling that Samsung’s U.S. arm announced earlier this month. Many expected the company to pull back the curtains on the new Galaxy Note at that domestic event, but that seems awfully unlikely now — the original Galaxy Note made its debut at the IFA show last year, so to trot it out on U.S. soil as opposed to one of the world’s largest consumer electronics events seems a little lacking in the grandeur department. Looks like it may be full speed ahead for the long-awaited 10.1-inch Galaxy Note tablet, especially considering that some online retailers will soon be pushing them out the door. |

| One Jackson Crowdsources Kids’ Apparel With Contests That Lead To Clothes You Can Buy Posted: 03 Aug 2012 06:00 AM PDT  One Jackson, the latest e-commerce startup to target the popular kids’ clothing market, is preparing to make a big splash with its public debut next week. The company plays in the same space as other online clothing startups experimenting with Silicon Valley-inspired business models, including the subscription-based offerings from Wittlebee and FabKids, for example, as well as the web-based consignment shop ThredUp. But One Jackson has a completely different idea. Instead of designing clothes in-house or aggregating collections from elsewhere, the site will serve as a platform for connecting consumers with indie designers through contests where shoppers vote on which clothes they would like to see get produced and sold. You can think of One Jackson as something like a Kickstarter, except without the upfront monetary commitment, perhaps. Or a better analogy may be the art and print-focused Minted.com. It’s about testing ideas with a community of potential buyers, then either bringing those ideas to market, or letting them fall by the wayside. It’s not an entirely bad idea, except that without an initial investment or deposit, there’s always the chance that some shoppers voting on the designs won’t actually end up purchasing. But according to co-founder and CEO Anne Raimondi, she doesn’t think that will be the case because community members are making a personal connection with the designer they support. “Parents really like to know who’s behind a product,” she says. “People want to support people who are creative and pursuing their dreams, and in particular in this audience of parents – and moms especially – I think that really resonates.” One Jackson also has some notable backers who believe this model can work, too. The company closed a seed round of funding in mid-May led by Accel’s Theresia Ranzetta and Trinity’s Patricia Nakache, and which also included investment from Next View (David Beisel), Floodgate (Ann Miura-Ko), and Aileen Lee‘s new seed fund, which we now know is called Cowboy Ventures. Since then, the company has been quietly running in private beta with some 3,000 customers, and over 200 designers who have actually submitted content to the site. There have also been around 1,400 designers who signed up for the service to take a look. The contests are handled by co-founders Michele Adams, Head of Design and Creative, and Gia Russo, Head of Merchandising, both former co-workers from Martha Stewart Living, who later co-founded their own company called MiGi. There, they produced a series of lifestyle books as well as branded products for home and baby which have been sold through Target, Babies R Us, Teleflora, Tiny Prints and Bed Bath and Beyond. In other words, these two know not just design, but also how to market and sell. One Jackson’s fourth co-founder is Yee Lee, formerly of PayPal and Slide. Contests begin with an inspiration board, which is based on the design team’s research and study of emerging fashion trends. Designers then have a few weeks to respond and submit their entries, which can range from pencil sketches to software-produced designs or even photos of handmade clothes which may have otherwise been sold on Etsy or in a local boutique. After some initial curation, shoppers then vote for their favorites, and optionally share to Facebook, Twitter and Pinterest. Based on demand and a little editorial intervention, the winning designs are sent off to manufacturing. The company works directly with manufacturers in L.A. (for denim), as well in Asia and Peru. Designers take home a minimum of $300 for being selected and then receive a 3% cut of the sales for the first 180 days their products are sold on the site. The plan is to bring in new lines every 4 to 6 weeks. At launch, the site will have around 80 to 100 items for sale in its shop (sizes 2-6), including accessories, and – surprise! – they’re starting with boys’ clothes, a desperately underserved market. Girls’ clothing will arrive by the holidays, however. For One Jackson, the long-term goal is to eventually speed up the whole process so they’re making just the right number of clothes to meet demand. “We envision a future where the batches get both faster and tighter in terms of units, so we’re really just producing what we know what people will want, and finding creative ways to shorten that cycle so we can get it into the hands of consumers faster, right after they’re excited about it,” says Raimondi. But for parents, there’s another benefit. “There’s just not enough uniqueness out there in kids’ clothing. Kids show up at the school or the playground, and they look like everybody else,” she says. “The goal is to keep our lines fresh.” |

| Posted: 03 Aug 2012 01:39 AM PDT  HTC has posted its Q2 numbers and they’re not pretty. While numbers were up on Q1, the Taiwanese Android/Windows Phone smartphone maker saw declines in nearly every line of earnings compared to the same quarter a year ago. Revenues were 91.04 billion Taiwan dollars ($3 billion), down nearly 27% on Q2 2011 (and missing consensus analyst expectations); gross profit was down by more than 30% to NT24.59 billion ($819 million); operating profit down by over 57% to NT8.2 billion ($273 million). Earnings per share were also down by nearly 57% to NT8.9 ($0.30) per share. HTC also provided a sober look at the quarter ahead. It expects that in Q3 revenues will drop even further to NT$70-80 billion ($2.3-2.7 billion), with the gross margin also dropping down to 25%, and the operating margin also coming down to 7%. The results show that despite gains in some key markets like China (and a slight one in the U.S.), HTC continues to see huge competitive pressure in the smartphone segment in which it competes. This year, in an effort to better focus the company, HTC launched a line of handsets under the brand “HTC One”, which followed a similar convention to Apple with its streamlined iPhone line-up. In its short earnings statement (which will likely see more elaboration during the conference call later today at 8AM Eastern time) HTC also emphasized its success in China, noting it was “well positioned to become a key growth driver.” Just as Canalys noted yesterday, the company highlighted operator partnerships as a key part of the equation, along with brand awareness and increasing retail presence. Overall HTC said Asia was meeting expectations for the launch of the One line. But noticeably the key North American and European markets did not get mentioned in that context. Instead, these have been seeing “increasing marketing and sales efforts in North America & EMEA.” Based on comments from April (via Slashgear), when HTC’s CEO Peter Chou was frank about how hard it would be for the company to claw back lost market share in the U.S. (where it currently accounts for only 6.4% of all smartphone users, says comScore), HTC may have already given up the ghost on this one. But if it is still holding out for a recovery, HTC will have to spend even more (read: more margin/profit pressures) to try to make better headway in these two markets, where it once commanded a respectable presence but has more recently been hit hard by competition, partly from Apple, but also from other Android players, primarily from Samsung. HTC, like Samsung, makes smartphones based mainly on Google’s Android operating system, with a secondary line based on Microsoft’s Windows Phone OS. But despite being a very early mover in smartphones — it was Microsoft’s first handset partner for its smartphone forays, and Google’s first Android handset maker — HTC has not managed to hold on to its lead. Unlike Samsung, HTC focuses only on smartphones (and, increasingly, a streamlined lineup of models). That means that HTC offers a less diversified range to the market, and that makes it more susceptible to feeling a pinch when its main/only line of business is not performing that well. While feature phones are getting gradually replaced by smartphones in the overall market, there is still a strong business to be had in the lower end models, as both Samsung and Nokia have shown. And it also provides a customer base loyal to a brand that can be tapped for upgrades. (Apple has been the one standout in the market that seems to have bucked this trend.) More to come. Refresh for updates. |

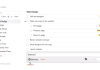

| Dear Facebook, It Could Really Be This Simple Posted: 02 Aug 2012 11:54 PM PDT

Oh ye of little faith: For the many of us who BELIEVE in Consumer Internet, it’s so painful to watch the Facebook/Groupon/Zynga stock trainwreck continue, with Facebook shares slipping to below $20 today, the lowest they’ve ever been. Shares slipped so much this afternoon that even our head-over-heels-in-love with-Facebook guy offered the former startup some monetization advice earlier, and if I were Facebook I would take it. The concerns about Facebook’s viability as a company have been hashed and rehashed by people barely if at all qualified to do so. At this point, we underqualified tech writers know them by heart: It basically boils down to mobile insecurity, a ~40 price-to-earnings ratio (based on revenue run rate) and whatever “I don’t trust Zuck” means, which makes But, the moment I figure out how, I still want to buy some Facebook stock at $20 because are you kidding me, that company is absolutely still growing despite almost no one seeing its potential value. Imagine if every friend that you, or I, or anyone on Facebook had, were a red-hot opportunity to turn well-wishing into revenue. That’s the promise made by Karma, Facebook’s recently acquired physical gifting startup. Facebook, you have the social graph. You have the users. You have the world. Now, all you need to do is give us an easy way to say “Happy Birthday.” With our wallets. The very top mock-up is indicative of the potential that being able to monetize online social interaction/goodwill represents. While we have no idea what Karma’s revenue or profit was pre-acquisition, rumor has it that the startup was raking in a cut of between 20% – 40% per purchase before it got scooped up. And now it has almost a billion users as a target market … if only some industrious engineer would build that very simple above link, and yes, figure out mobile. If Facebook continues to make these kinds of strategic acquisitions — i.e. buys Fab next — it will win. And, if it can leverage the physical goods loophole on iOS, it can become the social shopping platform. So buh bye lame “Social stories” and buh bye Amazon (which currently has a $100b market cap, around twice that of Facebook). Can someone please teach me how to buy Facebook stock now please? Because I believe in the future and you should too. Disclosure: I pretty much think I only own Aol stock at the moment, but would like to buy Facebook stock, see above. Also, there are exactly ten tickets left for our Facebook Ecosystem conference. Have at it. |

| The Platform Ecosystem Wars: Rome Is Burning Posted: 02 Aug 2012 06:30 PM PDT  Editor's note: Guest author Keith Teare is General Partner at his incubator Archimedes Labs and CEO of recently funded just.me. He was a co-founder of TechCrunch. It is either a good week to be having a CrunchUp focusing on the faltering Facebook ecosystem or it is a terrible week. Either way it is a compelling and interesting week, and whether it is good or bad depends on who you are and what your role is in the ecosystem. Following the departure of Ethan Beard (director of platform partnerships); Katie Mitic (platform marketing director) and Jonathan Matus (mobile platform marketing manager) this week; and the revelations from an embittered and chastened Dalton Caldwell, it seems to me that the tide is turning against Facebook as a reliable partner for developers to depend upon. In the very same week, Twitter has stirred up its developer ecosystem to fear that its latest moves are both self-serving and destined to punish their loyalty. One consequence of this has been the departure of Mike McCue from its Board of Directors. Google meanwhile is rumored to have stopped hires and acqui-hires related to its G+ ecosystem, which already has poor support for third party developers. There are common themes underlying the three major players struggles with how to grow revenue, particularly mobile revenue, while their web traffic is declining as a percentage of the total. They are all in a life or death fight, both with each other, but more importantly with the emerging mobile ecosystem, largely dominated by Apple. None of the three has yet successfully understood how to make money from mobile, despite — in all cases — reaching a point where mobile users outnumber desktop-only users and where the growth of mobile significantly outpaces that from desktop and laptop machines. In addition — especially for Facebook and Twitter — the drive to grow revenue in order to justify gigantic valuations overwhelms a natural desire to serve the needs of developers and users alike. In stream ads (Twitter); sponsored stories (Facebook) are both examples of flawed revenue strategies that directly conflict with a good user experience. There are a few possible explanations for what is happening. One is that both Twitter and Facebook have abandoned product-focused development in favor of revenue-focused development. Hunter Walk argues this convincingly in the case of Twitter in his widely-quoted piece this week. A second explanation is that there is simply too much power being given to non-product teams and that this has lead to confusion at both companies, nobody knows whether the product team is the tail and the revenue team is the dog, or the other way around. But that no clear strategy exists is obvious. Product and user focused thinking is in decline, it is akin to having chopped off the head of a chicken only to see it running around aimlessly, devoid of a brain. A third is that both companies are slowly and patiently building a more mobile-centric, revenue focused, version of themselves (include Google here too) and that version 2.0 of their ecosystems will differ significantly from version 1.0. This will impact both users and developers but will ultimately make them relevant to the future. Developers will – like the companies themselves – have to adapt or die. It is likely that there is some truth in all three of these points of view. It is also true that there is enormous danger in the transition they are all being forced to go through. Death is not to be ruled out. But it is also true that a failure to do anything, to rely on the old web-based, web 2.0 infrastructure and ecosystem, would inevitably lead to failure and irrelevance as new mobile-centric ecosystems emerge. Based on this there are some things we know about Facebook, Twitter and G+. What we know about Facebook

What we know about Twitter

What we know about Google+

Interestingly all of the above may represent an opportunity for Yahoo, under Marissa Mayer, to make a comeback. Yahoo really missed out on the decentralized world of web 2.0. It remained a centralized portal focused on content as the world moved to feeds, aggregation and syndication. Despite that it remained a very large, but restrained and under-monetized, property. In reinventing Yahoo, Meyer could do worse than try to figure out some of the new puzzles given birth by the growing app-centric mobile ecosystem. The one positive thing that this week has so far thrown light on is that there is a widespread recognition that things cannot stay the same. The Facebook of 2011, the Twitter of 2011 and the Google of 2011 are all understood to be in need of reinvention for a mobile-centric world with no clear strategy to make revenue. Rome is burning, but the recognition of the need to dispense with it and build the new ecosystem is widespread. In this new world Apple holds more aces than any other player. It has the largest ecosystem of devices, developers and revenues. It does not need advertising revenues, and it has a model that works for successful developers and itself alike. There are few if any disharmonies. Google, with Android, could put itself in a similar position if it could truly abandon its web-centric past and focus on Android as its central ecosystem. This, unlikely as it seems, would make a lot of long term sense. Facebook, relegated to being an app provider on the platforms of others, along with Twitter, seem to be in the weakest position, and need to be boldest of all. Investor pressure should not detract from product needs as they seek to chart their future. With developments this week, the three other players have all declared an intent to compete, even if it means destroying the ecosystems that have so far made them successful. Brave, bold and unpopular moves are always fraught with danger, and may indeed prove to be mistaken, But doing nothing isn't an option. Get your ticket for the CrunchUp if you want to understand more…… [Image via usu.edu] |

| Task Manager Todoist Receives a Major HTML5 Update Posted: 02 Aug 2012 05:43 PM PDT  Todoist is one of the oldest web-based task managers still available today. Yet, they unveiled a major update that takes advantage of some bleeding edge HTML5 features. In addition to demonstrating the latest technology improvements that can be implemented in a web app, it is still today a relevant task manager for individuals. The two main improvements of the new version are offline access with automatic synchronization — as previously seen in other web apps such as Gmail, Google Calendar or Google Docs – and considerably speedier performance. “My guess is that HTML5 is a new paradigm shift that will change how users perceive and use web applications,” founder and lead developer Amir Salihefendic said. In other words, he believes that HTML5′s web storage and offline support are as important as Ajax communication and HTTP server push, the technology that powers Facebook Chat and Gmail chat. But he is less optimistic when it comes to HTML5 adoption due to the necessary code rewrite. “HTML5 introduces a lot of new technical challenges and is probably the main reason why few web applications use it,” he said. Todoist stands apart from the competition thanks to its clean look and simplicity. “I want to focus on the way I can optimize productivity so busy people can achieve more,” Salihefendic says. In Todoist, tasks are a simple text string with an optional due date value. They can be nested and separated into different categories. Keyboard shortcuts, labels and Gmail integration are relegated to the background and reserved to power users willing to learn those features. With that update, Todoist now finishes loading in under 100 milliseconds. When you create a task, mark it as done or view another category, it happens instantaneously because everything is stored and executed locally before being synchronized with Todoist’s server. Since 2007, Todoist has accumulated more than 350,000 users and millions of tasks. But the introduction of that major update is a milestone for Todoist. “I can see that our usage numbers have sky-rocketed since the introduction of HTML5. We have almost seen a 50% increase of tasks being added daily,” Salihefendic says. They only received $40,000 in funding from Startup Chile, the program that encourages entrepreneurs to relocate to Chile, and have been profitable for years thanks to an optional premium subscription. Competitors include the oft-cited and veteran web app Remember the Milk, minimalist services such as Wunderlist and TeuxDeux and in some way team-based services such as Asana, Producteev, Flow and many others. |

| LevelUp Now Has $21M To Take On The Squares Of The Mobile Payment World Posted: 02 Aug 2012 05:19 PM PDT  Mobile payment service LevelUp, an off-shoot of Boston-based SCVNGR, announced this morning that it has raised $9 million from T-Venture, the venture capital arm of Deutsche Telekom. The investment is the second tranche of a larger funding round and brings the total raised to just over $21 million. SCVNGR itself has raised over $31 million. As a result of the investment, T-Venture Senior Manager Randeep Wilkhu will join the startup’s board as an observer. As for some context: Every day there's a new headline about mobile payments solutions. It seems that every carrier and credit card company has its own system, while all the big mobile players are working on one or have one already on the market (Google Wallet). The rumors indicate that the iPhone 5 will have NFC functionality to enable Apple’s entry into the mobile payments game. The point is: It’s easy to be skeptical of new solutions, especially when it comes to long-term viability. Yet, in spite of the apparent saturation and the success of Square and others, no one solution has emerged as the outright leader. That’s why Seth Priebatsch launched LevelUp (as an off-shoot of SCVNGR) in beta last July, hoping to create an easy, carrier and card-agnostic payment and loyalty system that could be used everywhere. Since then, the company has grown its U.S.-based staff to 162 and Priebatsch expects the team to grow to 200 by the end of the year. As of today, LevelUp users can pay with their mobile device of choice at 3,000 participating merchants, which include Ben & Jerry’s, Quizno’s and Johnny Rockets, and more than 200K users spend a total of $2 million per month using LevelUp. In turn, Priebatsch wants the service to be in 50 cities in the U.S. by the end of the year and said that they plan to announce some even bigger nationwide chains this fall. So, while there’s plenty of speculation over which of the major mobile payments players will crack the mainstream first, whether it’s Google Wallet, Isis, Pay With Square, or PayPal, perhaps the biggest validation for the service comes from the fact that several of LevelUp’s backers are now investing in the startup on top of their own mobile payment solutions. T-Mobile lent infrastructure and hardware to LevelUp to help it get off the ground, the founders of Discover invested in the startup’s first tranche — and now Deutsche Telekom via T-Venture. Priebatsch said that he believes this is a result of the fact that the startup is religiously attempting to remove the major barriers that prevent people from paying at local merchants with their phones. For now, that means LevelUp relies on the QR code as its main payment mechanism, but down the road that will mean adopting NFC. “We’ll do whatever it takes to get LevelUp into the hands of the masses,” Priebatsch tells us, “and that starts with providing value to merchants so they actually want to consider adopting another mobile payment network.” To do this, the startup recently announced that it has lowered its merchant interchange rate (a.k.a. “the swipe fee”) to zero. Now, LevelUp merchants pay 35 percent to the startup each time a consumer redeems first-time and loyalty rewards, so, because the revenue from this charge matched the interchange fees, Priebatsch says, the company decided to just go ahead and cover those fees itself. Why not? In turn, the team hopes that this will offer a better acquisition strategy, removing the friction for many merchants that would participate otherwise. With Square charging 2.75 percent and most others at 3 percent, LevelUp starts to look good in comparison. Merchants still end up paying more to LevelUp as part of that 35 percent charge, but the founder thinks that it can make up the difference by offering merchants one single solution for customer acquisition, retention, and analytics — exchanging zero credit card fees for a share of that business it creates by way of its loyalty rewards campaigns. There’s no reason that other companies with big mobile payments solutions (like Starbucks) couldn’t eliminate credit card processing fees, which would mean that LevelUp would have to compete with name brands — further tilting an already uphill battle. In the meantime, Priebatsch and the LevelUp team are pushing to scale the system in the U.S. (and internationally) as fast as possible, hoping to achieve enough penetration in the next year so that, when the cards fall, LevelUp will have a presence that will be hard to ignore. |

| How Facebook Could Save Its Shattered Share Price Posted: 02 Aug 2012 04:46 PM PDT  If Facebook’s share price continues to plummet, it’s going to have a lot tougher time signing and retaining the top talent who can answer its big questions. It needs more revenue, or at least clear ways of generating it to persuade investors. But payments aren’t growing anymore, and its current ads aren’t enough. It can’t wait to set the money-making wheels in motion. It needs decisive action, immediately. Here’s my breakdown of exactly what Facebook needs to do next if it wants to start clawing its way from $20 back to its $38 IPO price. Why is this a crisis? Last week’s earnings report showed that Facebook’s current business model isn’t built to last. That’s not to say it’s doing poorly now, and as a private company things would have looked alright. But as a public company reporting all its stats, there’s the perception it’s not succeeding, and that can actually hurt it. People are rapidly shifting to using the site from mobile alone, or at least spending a lot more of their time on mobile than desktop where it shows more ads. Facebook is only making $183 million a year on mobile ads right now. That doesn’t cut it. Meanwhile, with Zynga stumbling and gamers moving to iOS or Android where Facebook can’t take a cut of virtual good or content sales, its payments business is plateauing. And more generally, businesses view Facebook as a source of demand generation through brand advertising that could eventually lift their sales. They aren’t as sure it’s a way to instantly earn money through demand fulfillment like with Google Search ads. These factors are scaring away investors and sinking its share price. That lowers employee morale, makes them too focused on the balance sheet to chase big ideas, and reduces their financial incentive to stay because their stock or options aren’t valuable. This all makes top engineers, designers, product visionaries, and biz wizards more likely to join a competitor or startup, or less likely to sell their company to Facebook or let it acq-hire them. Some Facebook employees are already leaving, though many likely planned to before Facebook actually IPO’d. Still, we’ve heard Facebook doesn’t offer employees big enough follow-on stock grants after their four years of vesting. That combined with poor share price performance puts them at risk of brain drain. Facebook is at a new crossroads. When it was preparing to IPO, it was time to start thinking about better monetization. Now as it plunges towards half its IPO value, it’s entering a state of emergency. Billions of dollars can’t be made overnight, but if it can accomplish some of the things I lay out below, it could at least foreshadow a future worth investing in. More Sponsored StoriesFacebook is bringing in $1 million in Sponsored Stories sales a day, half on the web, half on mobile. However, the social ad unit isn’t rolled out on mobile for the whole world yet, and you only see the occasional Sponsored Story in your news feed. I’m seeing about one Sponsored Story for every 100 to 150 stories in my news feed. It needs to do this cautiously, it needs to watch the feedback and click through rates, but Facebook needs to steadily increase how frequently Sponsored Stories appear by at least 3x. It has successfully designed an ad unit that’s both unobtrusive and sometimes helpful enough to click, showing me interactions my friends have with brands — stories that could appear organically but that businesses pay to have appear more often or more prominently. Facebook may have cracked the code with Sponsored Stories, but now it needs to push that code. Offsite Ad NetworkMaybe Facebook would prefer to wait a few more years to let users get comfortable with ad network, one that allows other sites to target ads they host based on Facebook’s incredible stockpile of user data. It doesn’t have those years, though. It’s already piloting the program on Zynga.com, and it looks good. Now it should get cracking with the roll out to trusted sites and then any site that meets some basic criteria. Want ButtonFacebook needs to get the long-rumored Want button plugin out the door. Embedded on ecommerce sites, it would let users state that they want to buy something, allowing Facebook to target them with ads for similar products. The Want button could help Facebook drill down the funnel and become the last click before purchase. Mobile App AdsSince Facebook is integrated into so many apps as an identity and sharing system, it knows a lot about which apps you use. The Wall Street Journal reports Facebook is planning to apply this data to target people with ads for apps similar to the ones they already use. It should strive to convince app developers that not only do these ads deliver new users, but that they can then employ the installs to generate Sponsored Stories convincing a downloader’s friends to also buy. Facebook ExchangeFacebook is now serving its first retargeted ads based on cookies that show what other websites a user has recently visited. They’ll be very powerful for big ticket ecommerce, like travel, gadgets, and cars. It needs to get reports out the door proving they work, bring more demand side platforms into the program, and start pulling in solid cost per clicks. Ads Targeted By What People Are MentioningAlong with retargeting, Facebook Exchange includes a real-time bidding platform that lets brands instantly say how much they’re willing to pay to reach a certain user who is marked with a certain cookie. It needs to repurpose this real-time bidding platform to a different type of targeting: what people are currently talking about in status updates and wall posts. These could work better than the new Sponsored Results ads in the typeahead. Facebook tested “Related Ads” a year ago. If brought back, when a user posts something like “I want to buy a new camera” or “Anyone want to grab dinner?”, it could query advertisers and let them bid on serving ads for camera shops or restaurants. Gmail already does this based on your email content, though Facebook might avoid some creepiness by keeping related ad targeting based on content shared publicly or with friends, and skip targeting by what you’re saying in private messages. Social CommerceEven if Facebook could convince services like Netflix, Hulu, and Spotify to give it a 10% cut of the subscriptions it delivers, the total Facebook could earn wouldn’t be huge. And it if moved into processing payments for physical goods, where would people be buying them from? Amazon, Etsy, or other ecommerce hubs that would be reluctant to give Facebook a slice. That’s why all these other revenue streams considered, one of Facebook’s brightest hopes for monetization may actually be disrupting the social gifting business with Karma, a startup it acquired the day of its IPO. The idea is that Facebook already reminds you about the birthdays of friends. If it stuck a “buy them a cool, cheap gift or gift card” link beside the prompt to send them a birthday wall post, it could drive an incredible amount of sales. With just one 30% taxed $10 sale per each of the 432 million American, Canadian, and European users, it could earn an extra $1.3 billion a year and boost revenue per each of these users by 30%. What analysts and investors wanted on its earnings call was not for it to meet projections. They wanted clear signals that it would blow projections away in quarters to come. Instead they got vague messaging about mobile being a priority, the cautious ramp up of Sponsored Stories, and no real mention of innovative social commerce. Facebook needs to start checking things off this list and show the public market a solid foundation for the next few years. And really, that shouldn’t be too painful. I don’t think any of these money-makers would seriously jeopardize the Facebook experience, meaning it could live on to squeeze its users and enact its mission to connect the world for years to come. |

| Posted: 02 Aug 2012 04:28 PM PDT  Google announced a substantial update to its Wallet mobile payment service the other day, but it turns out the company may have been overstating things a bit. According a post on Google’s Commerce blog, the service now plays well with all major credit card types, but a representative from American Express pointed out that the statement wasn’t entirely accurate. Users are free to load American Express cards into the Google Wallet app and use them for in-store purchases, but American Express never officially signed off on that deal. “We want to make sure Google’s mobile wallet product meets the standards we set for our Cardmembers in terms of transparency and clarity about transaction detail,” AmEx social media VP Bradley Minor told me. “Right now, American Express does not have an agreement with Google for our cards to be used in the Google mobile wallet.” Very curious stuff. Minor went on to say the two companies had engaged in discussions about working together, but they hadn’t yet locked up an official relationship. What’s more, American Express has the ability to forcibly shut down AmEx card support through Google Wallet should things end less than amicably. That’s right, if you’ve linked your AmEx card to your Wallet account, you should probably get your NFC-enabled kicks in now. The big issue here seems to be how Google’s updated Wallet service handles those multiple credit card types. As it stands, in-store Wallet transactions are actually handled by a virtual MasterCard PayPass account locked up in the device’s secure storage area, and those transactions are subsequently passed along to whatever credit card account the user had actually selected. Not all of the pertinent purchase information (like the specific merchants the purchase was made it) is carried over along with purchase amount though, and American Express doesn’t like that. As for why American Express was name-checked in the big announcement post, all’s quiet on the Google front. I’ve reached out for comment, and will update once I hear back. UPDATE: Google has finally gotten back to me with an official statement on the issue, though it’s not the most satisfying thing you’ll ever read: “For many years, we’ve accepted American Express, Visa, MasterCard and Discover for online and mobile transactions. The latest version of Google Wallet extends these same benefits to people who choose to use the Google Wallet app to make purchases in-store. We are in active discussions with American Express and look forward to working together as partners as the world embraces digital payments.” |

| WordPress Launches Retina Support For Gravatar And All Hosted And Self-Hosted WP Sites Posted: 02 Aug 2012 04:08 PM PDT  WordPress’ Matt Mullenweg just announced that the WordPress.com interface and all the blogs hosted on the site are now optimized for high-density displays like the ones found on Apple’s new iPad and Retina MacBook Pro. Through JetPack 1.6, which also launched today, users with self-hosted WordPress sites can also enable the same functionality. The arrival of these high dots-per-inch (HiDPI) devices took many developers by surprise and while many Mac apps, for example, have already been optimized for Retina displays, most developers are still playing catch-up. Things are even worse on the Web. As Mullenweg notes, most web sites “don't have high-resolution equivalents of all their graphics to take advantage of the new screen, so they get "doubled" and look fuzzy, they stand out like a sore thumb.” With this update, WordPress.com will now serve high-resolution images on its blogs for all users who can see them. To do this, says Mullenweg, WordPress will take the images its users have uploaded and then sized down to fit their theme and serve them at a more Retina-optimized resolution. The WordPress team also optimized the dashboard, reader and all of its own sites to take advantage of these new high-density displays. As for self-hosted blog, WordPress plans to integrate all of these Retina improvements into its upcoming 3.5 release, but for the time being, users will have to enable these features through JetPack. Besides Retina support, the latest version of JetPack also introduces Pinterest share buttons. Gravatar, too, is now Retina-ready and, as the company puts it, its users’ profile images will now “be looking extra sharp to anyone who views [a] Gravatar profile or Hovercard from a device like the iPhone 4.” |

| FreeCreditReport’s Ed Ojdana And Facebook’s Chris Kelly Back Movie Distribution Startup GoDigital Posted: 02 Aug 2012 03:53 PM PDT  Preferred Ventures, the digital media investment firm launched last year by FreeCreditReport.com founder Ed Ojdana and former Facebook Chief Privacy Officer Chris Kelly, just announced that it has invested a “high six figure” seed round into GoDigital, a digital distribution service for independent films. GoDigital has a library of more than 1,000 independent, documentary, and foreign movies, which it makes available to viewers through deals with Lionsgate, iTunes, Netflix, Amazon, and others. Initially launched as a music distribution service, then switching to its current model in 2008, GoDigital has been bootstrapped until now. However, founder and CEO Logan Mulvey says the company reached a point where it needed more money to grow — hence the current funding. Ojdana is now the chairman of GoDigital’s board, and Kelly is joining the board as well. It’s tempting to look at the deal as a meeting of minds between the tech and movie worlds, and to a certain extent, that’s how Mulvey and his investors describe it, too. Mulvey, for example, says that in addition to the money, he was excited to bring a “different skillset” to the company’s leadership team. And Kelly says that since the early days of Facebook, he has been an advocate of ending the “oppositionalism” between Silicon Valley and Hollywood. At the same time, Ojdana and Kelly aren’t exactly neophytes in the movie world. For starters, they’re both executive producers on the recent documentary Jiro Dreams of Sushi — along with Kevin Iwashina, who represented Preferred Ventures in this deal. In fact, Kelly says that before investing, he tested out GoDigital by using it to distribute The Power Of Two, another documentary that he produced. As for where GoDigital comes from here, Ojdana says he’s hoping to improve the company’s marketing efforts. By building a database of customer viewing and preferences, the company could start recommending films that might appeal to you, Netflix-style — but where Netflix just recommends movies that are on Netflix, GoDigital can point customers to all of the platforms where they can download or view a given film, turning the site into a “one-stop shop” for independent movies. “We want to bring in some assets on the marketing side and make a difference on how independent films on monetized,” Ojdana says. |

| YC-Backed VoiceGem Brings Communication Back To The Future With Asynchronous Voice Messages Posted: 02 Aug 2012 03:34 PM PDT  Arda Kara and Alexander Blessing are from two pretty different places — Turkey and Germany, respectively — but as students pursuing master’s degrees in computer science at Stanford, they both faced very similar problems when it came to communicating with their family and old friends. Because of the massive time zone differences between California and Europe, it was pretty much impossible to schedule a time to talk daily on the phone or via Skype. Texts and emails were a bit too cold. Video messages through mobile apps such asSocialCam and Viddy were just a bit too high-maintenance — who wants to have to shave before sending a quick “Hi” to mom and dad? So they teamed up to build VoiceGem, a simple app for the web and the iPhone that lets you send and receive personal voice messages. VoiceGem, which is part of the current Summer 2012 class at Silicon Valley startup incubator Y Combinator, is launching in public beta today. What it does — and what it doesn’tSome of the most key things about VoiceGem are negatives, things it *doesn’t* require from users: It doesn’t cost any money. It doesn’t require special software. It doesn’t have you send or open any kind of attachment. It doesn’t require a special international calling plan or card — or even a phone number at all. It doesn’t need a high-quality microphone system. The initial use case was for communicating with family of all ages, Kara and Blessing tell me, so the aim was to make it as simple as possible. It works like this: VoiceGem senders sign up for the service using either an email address or Facebook account. They then type in their intended recipient’s email address, click the record button, and start talking (messages can be as long or short as they want.)The recipient then gets a message with a link that directs to VoiceGem’s website, where he or she can listen to the recording. The recipient can also reply to the VoiceGem message on the same thread, without signing up for an account. A simple idea that could take offVoiceGem’s founders don’t have any revenue generation plans at the moment, though they say that the app can be useful to businesses who want to communicate simple messages to their customers. This kind of use case could lead to a business model at some point, they acknowledged, but for now the focus is just on building the product out. In all, I think it’s a nifty service that could come in handy for a lot of people, not just people with family and friends scattered around the world. There is something nice about sending a quick greeting with the human element of your voice, without interrupting someone’s day by making his or her phone ring. Yes, it’s a small and simple product, but it comes from a smart place — and those types of things have been known to catch on pretty well before. |

| LocalBonus Raises $900,000 To Provide A Universal Loyalty Program For Anyone With A Credit Card Posted: 02 Aug 2012 03:26 PM PDT  There are all sorts of loyalty program out there, but let’s be honest — most of them are a pain in the ass to navigate. They require you to carry around a punch card, or you have to check in using some kind of mobile app, or use a specific rewards card. And each local merchant is tied to a different app or loyalty program, which means that users need to have various different apps or cards at the ready to capture rewards. New York City-based LocalBonus differentiates itself by offering up a “universal” loyalty program that doesn’t require users to download an app, checkin to a location, or carry around a punchcard to get points. Instead, it ties LocalBonus loyalty points to purchases made with a user’s debit or credit card. Once someone has registered a card with LocalBonus, then any transaction made at participating merchants will begin automatically accruing points. Those points can then be redeemed for cash at various increments. To improve its product and expand into other markets, LocalBonus has closed a $900,000 round of seed financing. The funding round was led by Payment Ventures, with Actinic Ventures and other angels also participating. Payment Ventures’s Tony VanBrackle, a vet with 25 years of experience in the payments industry, has also joined the board. LocalBonus currently operates in five different markets throughout the U.S., including New York City, Denver, Seattle, Portland, Sacramento. It works with other third-party loyalty programs, and has more than 800 merchants providing loyalty rewards through its service. The startup was founded by CEO Derek Webster, who previously worked at Oliver Wyman advising banks and payment networks on their payments strategy. Prior to that, he ran credit card product development at E*TRADE. The startup graduated from the Entrepreneurs Roundtable Accelerator program in April, and has been head-down since then signing up new businesses and seeking to expand its network of local merchants. |

| Hacker Posts Hilarious, Offensive Messages From Seven MLB Teams’ Facebook Pages Posted: 02 Aug 2012 03:05 PM PDT  Facebook pages for the Chicago Cubs, Chicago White Sox, Miami Marlins, New York Yankees, San Diego Padres, San Francisco Giants, and Washington Nationals were hacked today, as someone updated the teams statuses to a variety of funny (or offensive–or both!) messages. For the Chicago Cubs, the message was, “Fuck Bill Murray.” The White Sox endorsed Mitt Romney over President Obama: The Marlins announced the fan-favorite pitbull giveaway: The Yankees posted about a Derek Jeter sex change: The Padres post was less than welcoming to some fans: The Giants have no love for Chick-fil-A: And the Nationals announced they were heading back to Montreal: The Cubs, White Sox and Padres posted similar apology messages, while the Marlins, Giants, Yankees and Nationals have just removed the hacker post. While these posts were pretty harmless and entertaining, it isn’t good for Facebook or the teams that their accounts were hacked so easily. Big props to Deadspin for the screenshots. Update: A Facebook spokesperson tells me, ”Recently, several Pages made unauthorized posts as a result of actions from a single rogue administrator of these Pages. Our team responded quickly and worked with our partners to eliminate the spam caused by this attack. This was an unique, isolated incident and we are always working to improve our systems to better protect our users and their data.” Facebook and the MLB are still investigating the posts; I’ll be updating as more information becomes available. |

| Apple’s iPhone 5,2 Prototype Showing Up In Server Logs Posted: 02 Aug 2012 03:00 PM PDT  A few short days after rumors began swirling that Apple would hold this year’s fall event on Sept. 12, a reliable source just sent a screen grab of a next-gen iPhone popping up in his/her/its server logs. We weren’t able to glean any other info from the one session the prototype iPhone was engaged in, but the naming convention falls in line with what others have previously reported. It remains unclear if the iPhone 5,2 will go into production – as opposed to the iPhone 5,1 – or whether it will remain an internal-only test unit. Rumors are still rampant that Apple will increase the size of the screen from 3.5 inches (diagonal) to ~4 inches and that the 30-pin connector is being put out to pasture in favor of a smaller 19-pin version. Regardless, it appears Apple is close to finalizing the next-gen iPhone ahead of its purported product reveal next month. |

| Posted: 02 Aug 2012 02:29 PM PDT  LinkedIn CEO Jeff Weiner today addressed the company’s earlier incident of password theft, saying that it doesn’t seem to have an effect on growth. The theft, as well as the flurry of negative publicity, may have caused some members to question the professional social network’s ability to keep their data safe. However, during today’s conference call on the company’s second quarter earnings, Weiner said “the health of our network” remains “as strong as it was prior to the incident.” The company’s growth numbers seem to back that up. LinkedIn added 13 million new members in the past quarter, bringing the total to 174 million members. It’s also seeing an average of 106 million unique visitors each month. Back in June, it was revealed that 6.5 million million account passwords had been stolen and published online. LinkedIn hashed and salted its database, and it disabled accounts of members who were at “greatest risk”. The company said that none of the email addresses associated with the passwords had been published, and that it hadn’t detected any unauthorized attempts to access members’ accounts. Weiner said the company is still working to improve its security. The company is taking a $2 to $3 million charge for the next quarter to further invest in this area. |

| Activision Q2 Surprises The Street Again On $1.08B Revenue And $0.16 EPS, Raises Outlook Posted: 02 Aug 2012 01:36 PM PDT  Activision Blizzard announced its second quarter results today, beating estimates with net revenues at $1.08 billion, compared to $1.15 billion for the second quarter last year. Meanwhile, net revenue from digital channels came in at $343 million and represented 32 percent of the company’s total revenues, up from a 27 percent-share last quarter. Earnings per share came in at $0.16, compared to $0.29 for Q2 2011. The consensus on Wall Street was that Activision would see 18.7 percent revenue growth and 20 percent earnings-per-share growth to $829.7 million and $0.12, respectively. For the first quarter (the period ending March 31st), the company’s net revenues were $1.17 billion, with net revenues at $587 million and EPS at $0.33. So, all in all, Activision beat estimates, the fifth quarter in a row they’ve done so. And based on those better-than-expected results, the company is raising its calendar year net revenue and earnings per share outlook. Of course, as you can see from the chart above, put in context, it’s not all roses for Activision Blizzard. The company, like EA and others of its ilk, has found a rocky road during its transition to the social, mobile, ahem, digital era. In fact, rumors have persisted (via Bloomberg) that the company’s majority owner, Vivendi SA, is eager to sell its $8.1B stake in the company. What’s more, net income for the quarter came in at $185 million, down from $335 million in Q2 2011 and down from $384 million in Q1 2012. As a result, Activision ended the day down 5 percent and dropped an additional 3 percent in after-hours trading. Naturally, Activision CEO Bobby Kotick was optimistic in the company’s earnings statement thanks to its renewed international efforts and its gains online mitigating shrinking retail sales:

Somewhat surprisingly, Activision has become a bright spot among the videogame giants, weathering lethargic industry sales (especially for console games) by pushing out more content for Call of Duty and developing a new title in a partnership with Hasbro (Skylanders Spyro’s Adventure) that features console games and action figures, among other things. Zynga also recently inked a deal with Hasbro, as it the gaming giants look to stem slowing console sales with action figures and merchandising. And to that point, Activision performed markedly better than Zynga, which missed expectations in its own earnings announcement as well as Take-Two. EA hit expectations, but didn’t exactly look like the Hulk. As for other highlights, the company said that, unsurprisingly, World of Warcraft remains the top subscription-based MMORPG, with approximately 9.1 million subscribers, and announced that it expects to release its newest WoW title on September 25th — “World of Warcraft: Mists of Pandaria.” The company also claims that Diablo III, released May 15th, “set a new industry launch record for PC games” and was the best-selling PC game for the first six-months of 2012. As of July, more than 10 million players have joined in. Together, the company said, Diablo III, Spyro’s Adventures and Call of Duty represented three of the best-selling games in North American and Europe. “For the remainder of the year, we are excited about our product slate which includes Activision Publishing’s Skylanders Giants and Call of Duty: Black Ops II, and Blizzard Entertainment’s World of Warcraft: Mists of Pandaria,” said the Activision CEO. “While we are increasing our financial outlook for full year 2012, we remain cautious given economic uncertainty, risks to consumer spending especially during the holiday season and the recognition that the majority of our key franchise launches are still ahead of us.” For more, find Activision’s Q2 earnings release here. |

| With Competition Looming, Zipcar’s Q2 2012 Revenue And Earnings Disappoint Posted: 02 Aug 2012 01:27 PM PDT  Zipcar is seeing increased competition in the car-sharing market, which is one reason that it might not be growing as quickly as it, or analysts, like. Zipcar reported second-quarter loss of $422,000 today, or $0.01 a share, compared to a net loss of $5.6 million, or $0.17 a share, in the prior year’s second quarter. The earnings came on revenues of $70.8 million, which is up 15 percent from $61.6 million in the second quarter 2011. But Wall Street analysts expected the company to break even this quarter, with revenue rising 18.7 percent to $73.1 million. And Zipcar missed its own revenue forecast of between between $71 million and $74 million. Zipcar shares popped during the IPO, rising to nearly $30 a share. But ever since, they’ve been on a gradual decline, and closed out the day pre-earnings at 10:50. Zipcar saw its shares drop 6 percent in after-hours trading. In addition to its GAAP earnings, Zipcar reported it now has 731,000 subscribers, which is up 21 percent from the 2011 second quarter. It recently launched Zipvan service in Chicago and Toronto, and also expanded into Austin, Texas, with 40 vehicles there. Zipcar reported that in its established markets — which include Boston, New York, San Francisco, and Washington, DC — revenues grew 16 percent to $39.8 million. But less mature markets didn’t fare as well, particularly Europe. Scott Griffith, Chairman and CEO, wrote in the press release: “Despite these gains, we brought in fewer members than we had anticipated, and we faced economic challenges in our UK business. Moving forward, we are taking actions to maximize returns on our marketing spend, and we will be rolling out initiatives to accelerate adoption and expand our service offerings.” The report comes as Zipcar faces increasing competition in the car-sharing segment. It’s coming under attack from local services like City Car Share, and is seeing startups like peer-to-peer car rental services Getaround and RelayRides pop up. Earlier today, Getaround announced that it was launching Getaway, a service that will let its member rent out their cars full-time, which could instantly give it a fleet of cars to compete with Zipcar in launch markets like San Francisco and Chicago. And RelayRides recently partnered with GM and OnStar to get more car owners sharing on its peer-to-peer marketplace. |

| The Protean Echo Reduces All Of Your Credit Cards To One Ubercard Posted: 02 Aug 2012 01:23 PM PDT  Ready to enter a cardless future but not quite sure about NFC? The Protean Echo might be for you. This clever project essentially captures your credit cards onto one multi-purpose card that can hold up to three cards at a time. It works like this: you scan your magnetic stripe cards into a smartphone app using a supplied dongle. You can then “upload” three cards to the Protean Echo and select them by tapping one of three touch-sensitive spots. The Echo’s batteries last for 2 years and you can store as many cards as you want on your phone. The Protean Echo uses a dynamic stipe system to mimic the way credit cards store data on the fly, thereby reducing clutter in your wallet. Now obviously what we’re dealing with here is a card skimmer with some very cool, Terminator 2 Edward Furlong-type technology. Presumably you wouldn’t skim other people’s cards and only yours and you’re obviously going to meet some uptight merchants who want to see the original card so I suspect the use case will be limited to swiping at unattended kiosks or ATMs. Plus, it’s just some credit cards. It’s not that big a deal to slip them into a wallet. Regardless, these guys are going to give it a try and for $80 you can reduce the size of your wallet by at least three credit cards. They’re planning a Kickstarter launch shortly and you can check out the website here. |

| You are subscribed to email updates from TechCrunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

0 comments:

Post a Comment